One of the biggest issues faced by Oil & Gas companies is inventory valuation, particularly the operations governed by joint ventures where partner agreements complicate business relationships and need careful financial statement reporting in the operator and non-operators accounts. For instance, ventures’ operators oversee the extraction of natural gas and carry out the liquification or gas processing activities to create products like liquified natural gas (LNG), gas condensate, or natural gas liquids (NGLs). These products are extracted from offshore or onshore fields and acquired without purchase, the true cost of natural gas can only be determined by adding the operation cost to the manufacturing cost to calculate the actual cost of the final products.

Even though the venture operator is entitled for an equity share of the production as stated in the JV agreements, the actual lifting of final products always result in variances that need to be accounted for with the calculation of under or over lifting.

Owing to increased expenses per yield, events such as a turnaround or shut down for plant maintenance would cause the stock valuation of the affected periods to be overstated, since the valuation of products in the operator books is entirely dependent on the operating costs. To smooth out the impact of these occurrences, costing strategies such as inception-to-date (i.e. the total actual activity in terms of costs and production quantities that occurred since the start of a project) costing are normally employed.

In the books of non-operators, however, the need to cost inventory at inception-to-date is driven by other challenges, mainly because the products lifted by non-operators are received at an estimate cost (as it is not actually purchased). An accurate valuation of products usually relies on the cost report from the venture’s operator. These reports are typically received a month later and after the closing of the financial period.

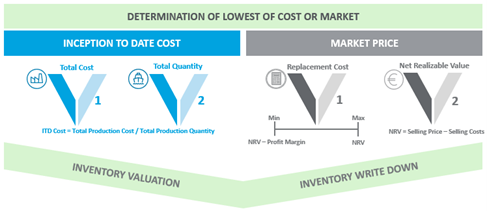

According to the Oil & Gas industry practice, when market prices are less than actual costs, inventory is often written down using the lower of cost or market (LCM) method. The market or replacement costs are compared with inception-to-date costs. Replacement costs should normally range between the net realizable value (NRV) minus the normal profit margin (as a minimum value) and NRV (as a maximum value). When the replacement cost is outside this range, NRV prices are used and compared with the inception-to-date costs (Figure 1).

Figure 1 - Determination of Lowest Value for Inventory Write-Down

Navigating the Features and Boundaries of Material Ledger within SAP S/4HANA

In SAP S/4HANA, Material Ledger underwent a redesign, simplification, and enhancement of several features to align with the new data structure. For architectural reasons, the alternative valuation tool no longer supports delta postings. The posting of alternative valuation in Material Ledger, Financial Accounting, and Management Accounting can only be completed on a parallel ledger using an accounting principle that hasn’t been applied to actual costing during the same period if actual costing has already been completed.

In addition, alternative valuation can be used to produce values in accordance with particular methods of valuation that can be stored in a valuation alternative, like the “rolling runs”, which can be used to compute a cumulative actual cost or an inception-to-date cost used for actual costing. These methods can also be used to create a statistical settlement for reporting purposes based on valuation alternatives.

The recommended SAP program primarily focuses on creating records for legal valuation. While it does not specifically address the transfer of data necessary for group valuation, which is important for eliminating profits in inventory for group consolidation and reporting—and profit center valuation—critical for calculating transfer prices when goods are exchanged between units or profit centers—the program effectively transfers values generated from the alternative valuation with rolling run in a valuation alternative, making them ready for actual costing.

Overcoming Challenges with Inception-to-Date Costing

In this situation, the inception-to-date stock valuation and write-down must be handled on the same ledger that is assigned to IFRS accounting principle. These valuations are required during the same financial period and parallel views for group and profit center valuations are also activated.

The valuation and revaluation requirements presented an opportunity to enhance the current Material Ledger solution in S/4HANA. Recognizing the importance of these valuation methods to the customer’s venture agreements, we collaborated with SAP to refine the solution. This proactive approach ensures that customers can avoid manual processes for inventory valuation and journal entry creation, thereby supporting a seamless and automated end-to-end process with all material movements accurately updated.

To overcome these challenges, our key goals were to:

- Meet the requirements of inception-to-date costing by leveraging the capabilities of the “rolling run” method.

- Limit the write-down of the lowest of cost and market or delta posting to financial accounting and rely on the reporting capabilities of the alternative valuation program in Material Ledger.

Our team at Deloitte analyzed the standard solution and identified opportunities to enhance the overall process to better meet business requirements. Collaborating closely with SAP, we improved the program used to transfer “rolling run” to actual costing, ensuring it aligns with our process needs. These enhancements seamlessly integrate the material ledger alternative valuation for statistical reporting with the balance sheet valuation capabilities for delta posting.

As shown in Figure 2, the procedure has been streamlined into 5 simple process steps that fully automate the computation of inventory value, revaluation, and reporting. Additional potential for automating the computation and updating of market prices has been investigated.

Figure 2 - Period-End Valuation, Revaluation and Reporting

Enhancing Inventory Valuation Processes with Deloitte’s Expertise

This blog discussed the complexities of inventory valuation in the Oil & Gas industry and how leveraging the “rolling run” method in SAP S/4HANA Material Ledger can streamline the process. At Deloitte, we are dedicated to helping companies optimize their inventory valuation and financial reporting. Interested in how Deloitte can support your company in optimizing inventory processes with SAP solutions? Connect with us today to discuss the possibilities.